Latest News

Bridging Institutions,

Tokenizing Possibilities

Discover tokenized assets with our proven solutions for institutions and our well-established ecosystem.

Digital Infrastructure for RWA

Instant Settlement Network

Trading Portal Across Licensed Intermediaries

Liquidity Arrangement Between TradFi and DeFi

What makes NVT different?

Discover the Institutional RWA Solutions

Empower institutions with RWA platforms, virtual asset brokerage, and secure enterprise wallets.

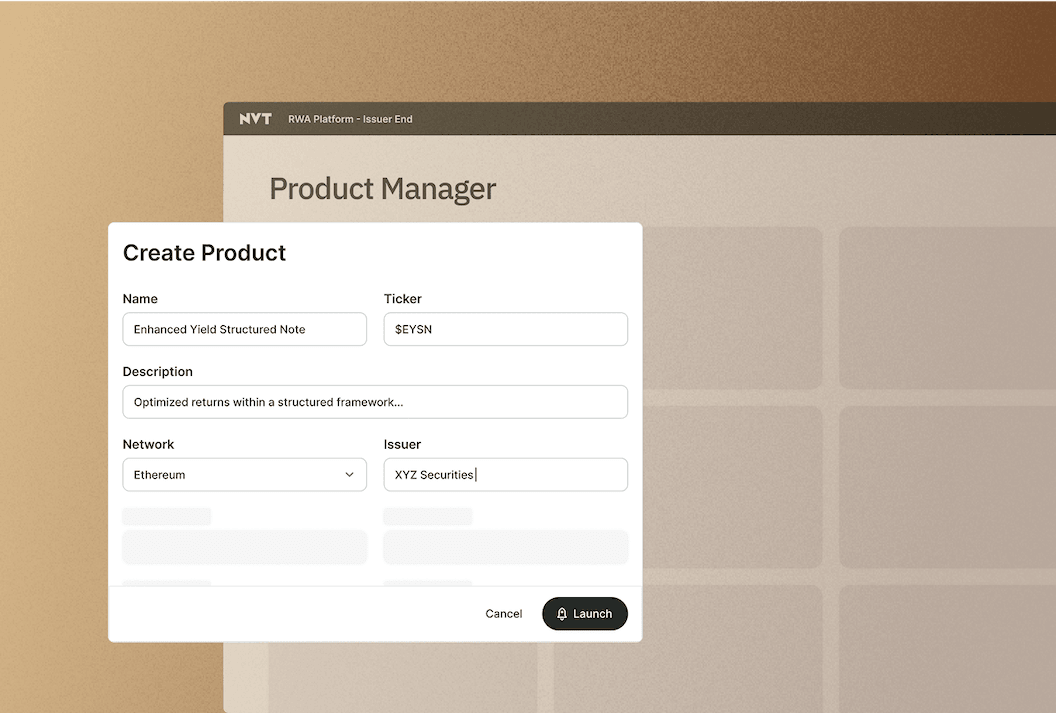

RWA Platform for Issuers/

Distributors/Process Agents

Streamline asset tokenization and trading with our RWA platform, ensuring fast, secure settlements and efficient financial operations.

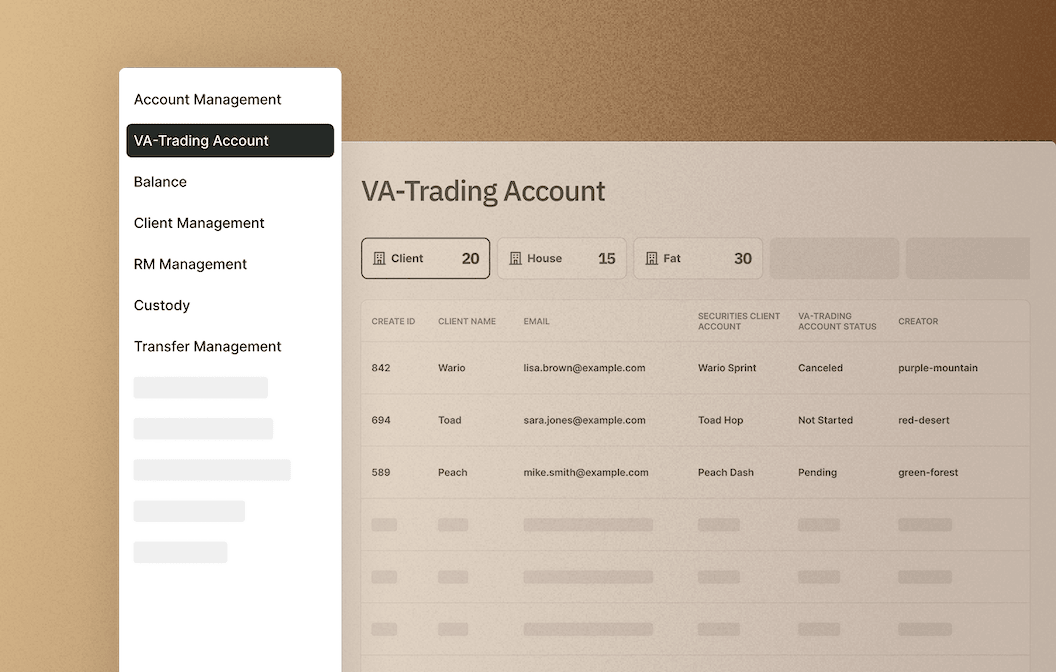

Virtual Asset Brokerage Systems

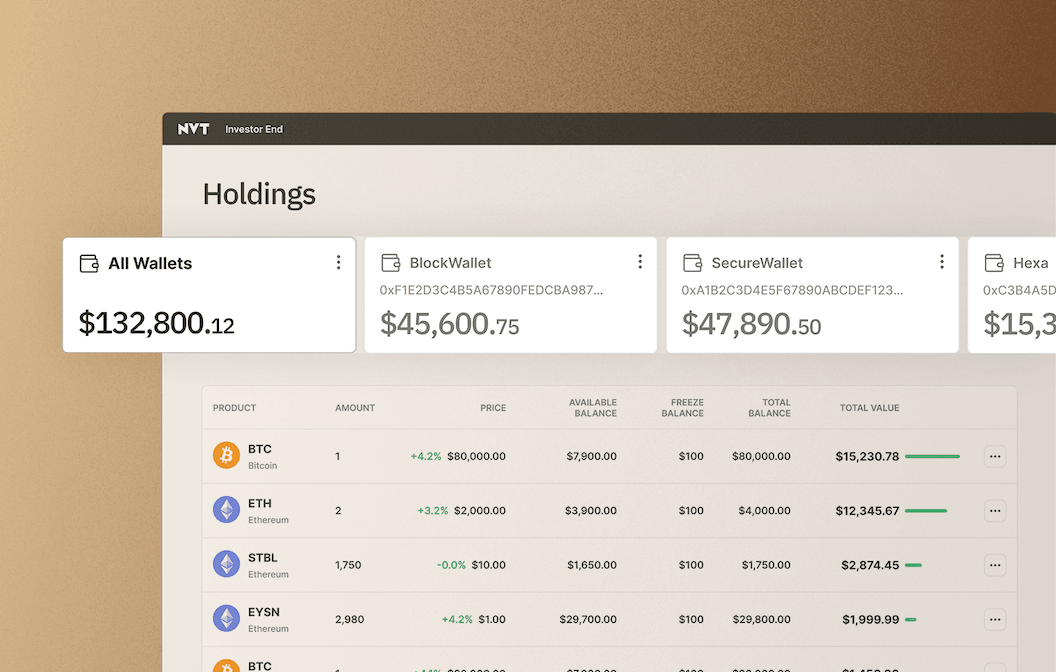

Enterprise-Grade Digital Wallets

Let’s Reshape Finance Together

Get In Touch

Contact us today to learn how NVT can support your business.